Il Chiaro Finanziario Weekly Update: August 10–16, 2025

Global Markets, Economies, and Interest Rates

Table of contents

This week offered a complex picture, with global markets moving between euphoria and uncertainty. The scene was dominated by a powerful rally, driven in particular by Asian indexes and an American tech sector that, while volatile, continues to show surprising strength. In this in-depth weekly analysis of the markets, we will examine the unexpected rise of global markets, the contradictory signals from national economies, and the two-speed performance of key sectors.

Global Markets: A Multi-Speed Growth

The past week was marked by a generalized rally, but with significant differences between the various financial centers. The Nikkei 225 posted a powerful +3.7%, a testament to Japan’s robust recovery. The Chinese indexes Hang Seng and Shanghai Composite also closed the week in positive territory with a +1.7%, confirming their momentum.

In the United States, the main indexes showed more contained but still solid gains: the NASDAQ Composite rose by 0.8%, while the S&P 500 and the Dow Jones gained 0.9% and 1.7% respectively. Once again, performance was driven by technology stocks and cyclical sectors.

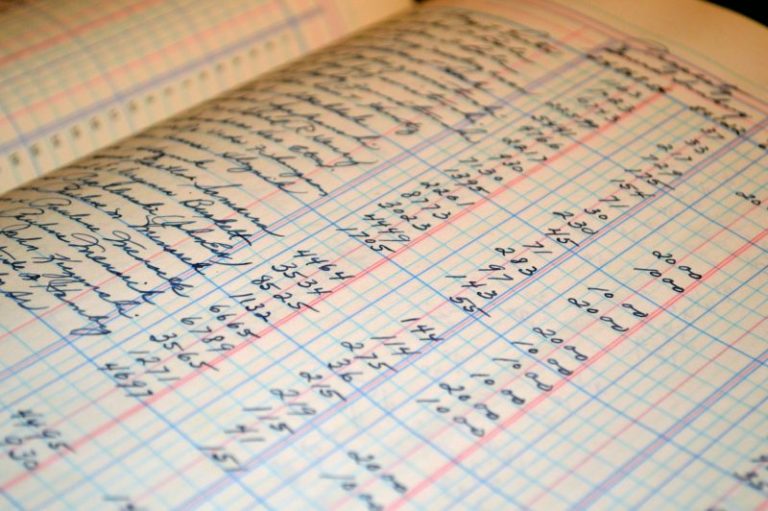

| Index | Last Value | 1-Week Return | 1-Year Return | 52-week High/Low |

| NASDAQ Composite | 21,622.98 | 0.8% | 22.6% | 21,803.75 / 14,784.03 |

| S&P 500 | 6,449.80 | 0.9% | 16.1% | 6,481.34 / 4,835.04 |

| Dow Jones | 44,946.12 | 1.7% | 10.5% | 45,203.52 / 36,611.78 |

| Nikkei 225 | 43,378.31 | 3.7% | 14.0% | 43,451.46 / 30,792.74 |

| Hang Seng | 25,270.07 | 1.7% | 45.0% | 25,766.62 / 16,964.28 |

| Shanghai Composite | 3,696.77 | 1.7% | 28.4% | 3,704.77 / 2,689.70 |

| CAC 40 | 7,923.45 | 2.3% | 6.4% | 8,257.88 / 6,763.76 |

A Look at Earnings and the Immediate Future

The past week in global markets saw a mix of surprises and confirmations from corporate balance sheets. Ibotta Inc., a marketing technology company, recorded an impressive 29% growth in quarterly revenue, while Swisscom, the Swiss telecommunications giant, showed a slight contraction in revenue, but with signs of stability from its Italian operations.

The coming week will be crucial with key companies’ quarterly reports, such as Palo Alto Networks (cybersecurity), BHP Billiton (raw materials), Home Depot (retail), and Target (retail). Their performance will provide important clues about the health of their respective sectors and could generate strong volatility.

| Company | Date | EPS Estimates | Revenue Estimates |

| Palo Alto Networks (PANW) | 18.08.2025 | $0.88 | $2.5 Bln USD |

| Bhp Billiton (BHP) | 18.08.2025 | $1.08 | $29.081 Bln USD |

| Home Depot (HD) | 19.08.2025 | $4.72 | $45.44 Bln USD |

| Target (TGT) | 20.08.2025 | $2.02 | $24.94 Bln USD |

| Analog Devices (ADI) | 20.08.2025 | $1.95 | $2.76 Bln USD |

Global Markets, Central Bank Policies and Interest Rates: The Imminent Turning Point?

The debate over interest rates is more heated than ever and represents the key issue for the global economy. In the United States, San Francisco Fed President Mary Daly stated on August 6, 2025, that the central bank will likely have to cut rates “soon,” signaling a possible turning point in monetary policy. This statement aligns with market pressures: investor Scott Bessent even suggested that the Fed’s rate should be 150-175 basis points lower. The consensus is that a slowdown in the labor market and a decline in inflation could push the Fed to act, making a cut by the end of the year increasingly likely.

The situation in Europe is more cautious. The Bank of England made its fifth cut since 2024, bringing the rate to 4%, but Chief Economist Huw Pill warned that the pace of cuts will slow down. The European Central Bank (ECB) has so far taken a “wait-and-see” approach, not wanting to accelerate cuts without signs of a significant economic deterioration. Some prominent analysts, including Goldman Sachs, believe that the ECB’s rate-cutting cycle may even be over.

In emerging global markets, the trend is decidedly more aggressive, a testament to economies that need strong stimulus for growth. In July, the highest pace of cuts since 2022 was recorded, for a total of 625 basis points in a single month. In particular, Australia cut its rate by 25 basis points, pushing local banks to reduce mortgage rates and provide direct support to the market.

Long-Term Outlook: The Common Thread of the Economy

This week’s analysis confirms a recurring trend: the divergence between global markets and macroeconomic data. Markets continue to move in a rally fueled by expectations and specific themes like AI, but signs of a slowdown in the real economy, from the US housing market to production in Italy, suggest caution. The real “common thread” is the persistent uncertainty about interest rates, which continues to weigh on sensitive sectors like real estate and polarize corporate performance. The question is no longer “if,” but “how much and when” central banks will act to support growth. The ability to select the right stocks and read the signals beyond the simple indexes will be the key to navigating this context.