The Weekly Brief from Il Chiaro Finanziario: September 2-6, 2025

Table of contents

It was a transformative week for the stock markets, driven by an unexpected signal of weakening from the US employment front. The weaker-than-expected data reignited hopes of an imminent Federal Reserve rate cut, prompting investors to bet on monetary easing and influencing the direction of global markets.

The Fed and US Employment: Impending Rate Cuts?

The spotlight was on the Department of Labor’s report, which showed an increase of only 22,000 non-farm jobs in August, well below the 75,000 estimated by analysts. The unemployment rate also rose to 4.3%, the highest level since 2021. This sharp slowdown pushed the stock markets to revise their expectations. According to Investing.com’s Fed Rate Monitor Tool, traders are now betting with a 92.4% probability on a 25 basis point rate cut in September, with a small but not negligible 7.6% probability of a 50 basis point move.

Economists at Morgan Stanley, CIBC, and BoA Securities agree that the Fed will move in the fall, with Morgan Stanley and CIBC expecting cuts in September and October. The weak employment data provides the Fed with the political and economic cover to act.

Stock Markets Rise: The Stocks That Led the Market

The increased expectations for a rate cut gave momentum to Wall Street, with indices hitting intraday highs. The technology and real estate sectors were among the biggest beneficiaries. Among individual companies, Broadcom was a protagonist, jumping 11% on solid quarterly results and a forecast of strong growth in AI-related revenue for 2026. Samsara also saw a significant increase of 17.8%, beating revenue expectations. Tesla rose 3% after proposing an ambitious compensation package for Elon Musk.

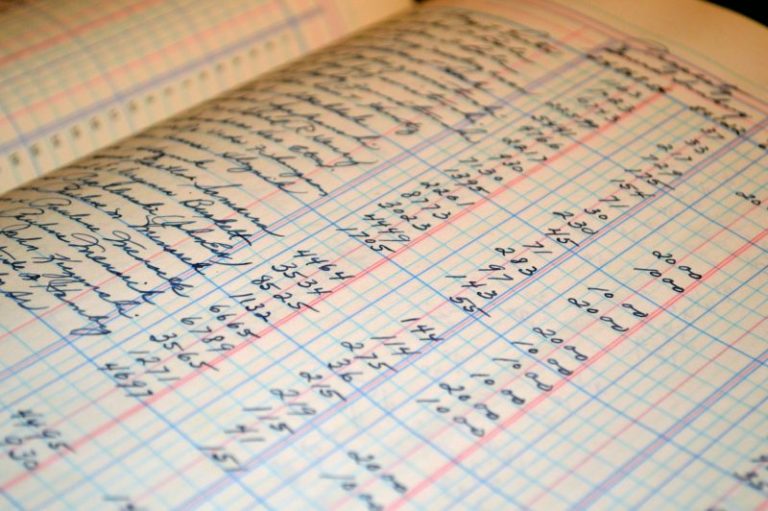

Market Performance Comparison – September

The start of September showed decisive movements, with a clear contrast between the rally in Asia and the consolidation in the US and Europe.

| Index | September Change |

| Dow Jones Industrial Average | – |

| S&P 500 | +2.2% |

| Nasdaq Composite | +2.5% |

| FTSE 100 (UK) | +0.5% |

| CAC 40 (France) | +0.5% |

| Euro Stoxx 50 | +2.9% |

| DAX (Germany) | -1.4% |

Stock Markets: The Impact of Economic Data on Europe and the USA

Economic signals were mixed. In the US, despite mortgage rates falling, mortgage applications dropped by 1.2%. This indicates that, even with a lower cost of money, home buying activity has slowed down. Meanwhile, in Europe, uncertainty is growing. German industrial orders unexpectedly fell by 2.9% in July, missing negative forecasts. But the main focus remained on France, where debt problems are considered too severe for the European Central Bank to solve. A BCA Research report highlighted that France’s total debt is at 325% of GDP and its primary deficit is the worst in the G7.

Stock of the Week (UTHR)

The spotlight is on United Therapeutics Corporation (NASDAQGS:UTHR), an American biopharmaceutical company specializing in the development of therapies and technologies for patients with chronic and life-threatening diseases. Founded in 1996, the company has established itself as a leader in the treatment of pulmonary arterial hypertension (PAH) and other lung diseases, with a portfolio of key products such as Remodulin, Tyvaso, and Orenitram. The company is also at the forefront of research for the production of bioengineered organs for transplants, an area that represents a fundamental mission and great growth potential.

The drivers of the rally

The stock registered an impressive rally of +24.8% in the last month, fueled by a series of positive news and extremely solid fundamentals. Among the main catalysts is the announcement of positive results from the TETON-2 study for its drug Tyvaso in the treatment of idiopathic pulmonary fibrosis (IPF). This success led several investment banks, including UBS and Jefferies, to raise their price targets on the stock, strengthening investor confidence. In addition to clinical success, UTHR combines an intrinsic business quality with top-level technical momentum. Its ROIC (return on invested capital) of 19.0% and a net margin of 40.4% are indicators of above-average operational efficiency.

Valuation and outlook

From a valuation perspective, UTHR presents as a “quality stock” at a reasonable price. It boasts a forward P/E of 12.6x, well below the sector average, and a PEG forward of 0.87, which indicates that the market is not yet fully pricing in its growth potential. The expected 5-year earnings per share (EPS) growth is 13.3%, a solid figure that makes the stock very attractive.

Points of attention

Although the picture is very positive, it’s important to consider the risks. The RSI above 70 suggests that the stock could be subject to short-term profit-taking. Furthermore, while EPS growth is solid, it is not “explosive” like that of some “hyper-growth” stocks, requiring a medium-to-long-term investment view.

A Look Ahead: What to Expect from the Next Data

The stock markets are now preparing for the next Fed decisions and future economic data. The hypothesis of a September rate cut is now almost a given, but investors remain attentive to signs of persistent inflation. Political uncertainty in France and the decline in German industrial production highlight the risks that European markets must face, emphasizing how political decisions have an increasingly greater impact on a global scale.

Disclaimer and Source This content is for informational purposes only and does not in any way constitute investment advice. Source: Investing.com